I got the house I wanted. Now what? Time to pay off the ball and chain known as a mortgage.

Most blogs out there I’ve read have said the same thing. Budget!

But the problem with most blogs is the person who is saying they paid off $95,000 in debt in 2 years had to learn basic financial intelligence. They had jobs that paid them $40,000 or more a year and they just went crazy with credit cards and buying stupid things and racked up bad debt and then couldn’t afford more then the minimum payment. All they have to do is learn basic financial intelligence such as, don’t buy a new car every year, don’t buy stupid stuff that has no value in their life like 8 pairs of shoes just because they are the new hip thing to own.

Let me tell you my situation.

I work full time at a job I like but I don’t make much money. I make about $27,000 a year – gross. What does that mean? I make 27k a year before everything is taken out of my paycheck. Taxes, insurance and benefits are all taken out before I get my paycheck. So in actuality, I make about $18,000 per year – net. Net is the money left after expenses.

So I have to pay off a mortgage with $18,000 a year and my base mortgage payment is about $850 a month or $10,200 a year. That is without the extra principal each month.

So what is someone like me to do? How am I going to pay off the mortgage early?

Here is what I do:

Live with someone

I live with my girlfriend and she helps pay for bills and the mortgage by giving me $600 a month. You can do the same with a room mate or someone you know that can live with you. I’m the kind of person that will go into debt to escape room mates. My girlfriend however is with me in the regard. We both hate room mates but can live together no problem.

Start budgeting

I’ve done this on a mental note my whole life but never in a serious way. I knew that I need a certain amount at the end of the month to make the mortgage payment so I don’t get foreclosed on. But lately, I’ve upped my game on budgeting. I’ve started a spreadsheet that tracks my reoccurring costs such as bills and non reoccurring costs such as home and car maintenance.

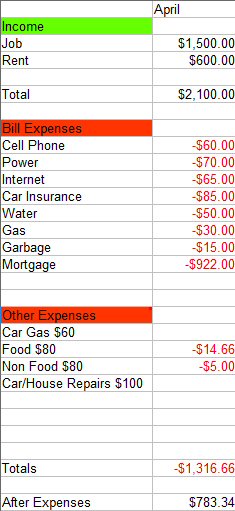

This is the first iteration of my budget and I’ll adjust as I go but this is the basis what budgeting looks like.

The income is pretty much fixed. I’m looking into starting a side hustle for extra income but at the moment, this is how much income I get per month.

Bill expenses are the fixed expense. My bills vary from those numbers. For example, my gas bill can be as low as $19 all the way up to $30. In my budget, I put the highest the bill was ever in my time living in my house. That way, I’ve budgeted for the highest amount that I could spend on that particular expense so if I do a good job and my gas bill goes down to $15 for this month, I have extra money left over at the end of the month that I can put towards the mortgage principal. Over estimating on expenses can really help you in being frugal. If you think that your bill is going to be higher then usual, you won’t want to spend as much on non fixed costs like non food items to make sure you will have enough at the end of the month.

Important! You may notice that my mortgage expense is higher then what I said it was in the beginning of the post. That is because I budget my minimum mortgage payment with some principal already added. So if I cut my budget too short one month, I still can add some extra money to the principal.

The other expenses category is non fixed expenses. My car needs gas about ever 2 and half weeks if I only drive to work. If I decided to go out of town, I’ll need to get gas 3 times in a month rather then 2 so my budget of $60 of gas may be getting close to the limit since I budget for only 2 trips to the pump. What I plan on trying is a combined non bill expense category of a fixed amount such as $400 a month. That $400 is used for everything else that isn’t a bill. Food, gas, non food items like clothes and car and house maintenance.

Car and house maintenance get their own budget because anyone smart who owns a car knows that they have a lot of maintenance up keep. Oil changes, new tires, new batteries, fluid changes. I still drive my first car that was hand me down when I turned 16. A 1996 Honda Civic with 215,000 miles. I do all the work on it myself and have saved thousands in repair costs. Most people are intimidated by car maintenance but we fear what we don’t know anything about. The cure for fear is education. In the age of the internet, there is nothing you can’t learn in a few minutes of searching and reading.

An example for car work would be, driving around in my car and then I hear a grinding sound when I brake. Get onto Google, type in “grinding sound when I brake” and you’ll get a myriad of results on what the problem might be. People will even post how to videos for your particular car and how to do the work yourself with what tools you’ll need. There is personal and financial investment in car care, but the dividends greatly outweigh the cost and you can keep a 20+ year old car on the road running great.

House maintenance is another one that like car maintenance, likes to pop up at the worst possible times. But, like car maintenance, you can find the solution to your problem by searching for it online. I bought my house with no knowledge of building anatomy (what’s a joist?) and used the internet to my advantage. As things go wrong, I search up on the internet what the solution is.

A real life example on my own house, I live in an area in the U.S that gets a lot of rain. Drainage is very important on the exterior of a house. In my home inspection report before I bought the house, it said that the gutters let out too close to the foundation. So I searched online for solutions. There were tons of options available. Some fancy options such as hiring contractors to come to your house and dig trenches for french drains that connect all the gutters to the street gutter and DIY options for digging your own trenches with regular corrugated plastic pipe attached to the downspouts and lead the pipe away from the house. Guess which one I did? I went to the hardware store and bought a 30ft roll of corrugated plastic pipe, dug out a trench just deep enough the hide the pipe and run it in the ground away from my foundation. Total cost? $75 for the materials and shovel and a lot of personal labor.

The point is learn to do things yourself. Not only will you learn some useful life skills that doesn’t get taught in school, but you’ll save money on doing things anyone can do. This applies everywhere in life not just physical work. I could have paid someone to do my budget for me and no doubt they would have done a great job, but it’s an added expense that I don’t need.

TL;DR

Over estimate your expenses. Work on decreasing expenses even if it’s a small amount. Work on supplementing your income with side work to increase income. Learn financial intelligence, spend money on things that matter and not on things that don’t.